The key is to keep them up-to-date and relevant. In this instance, you can use your likely sales to predict how much these costs will be.Ĭash flow forecasts are pretty easy to prepare.

Variable costs are the opposite – they’re usually dependent on the sales you make.Add these dates and projected amounts, including bills, fees, memberships and tax payments. Fixed costs include rent and salaries, and will stay the same regardless of how much you earn.Your business will likely have fixed and variable costs, and both will need including.

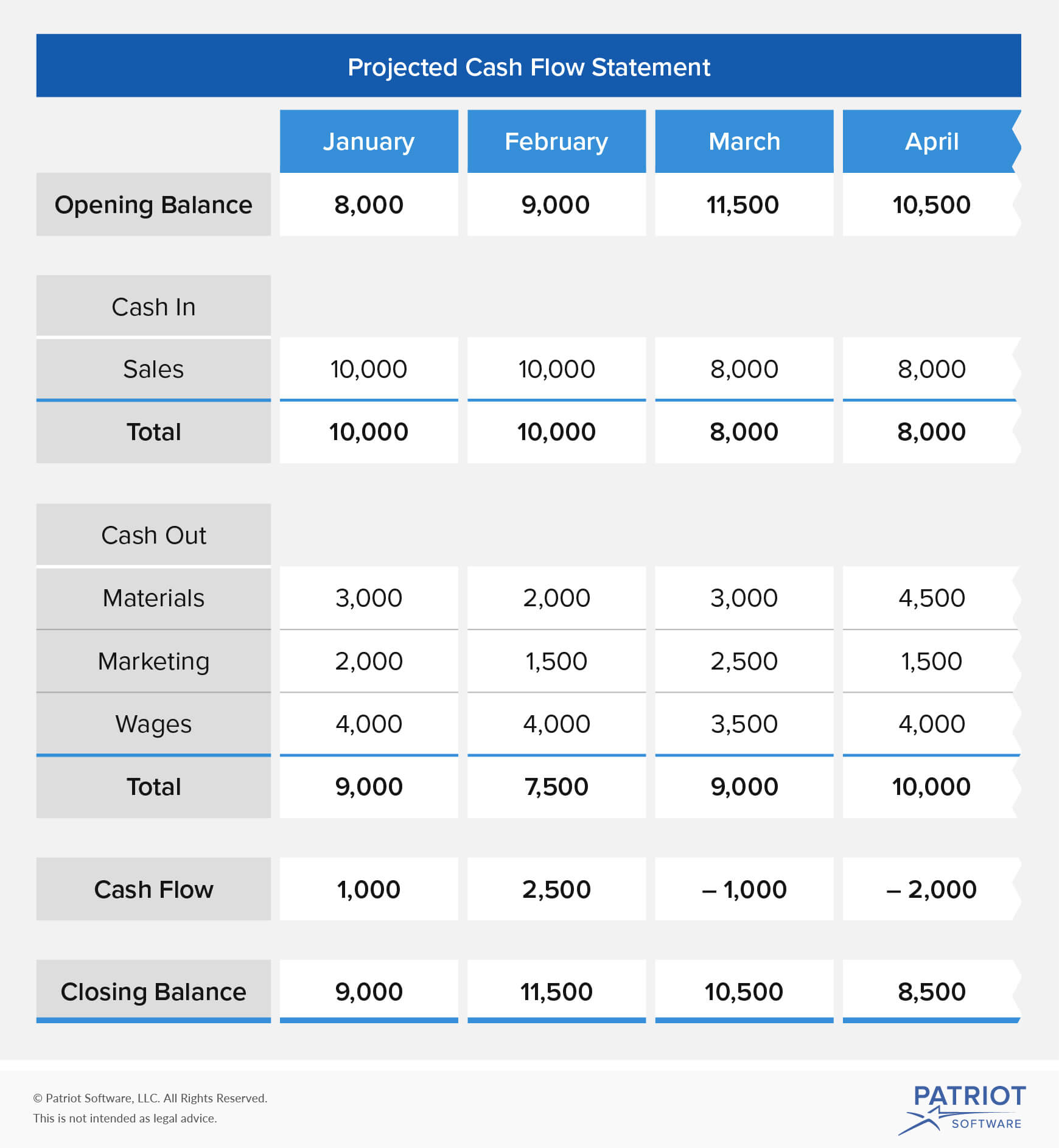

So now your cash flow forecast shows you how much income you expect, and when you expect to receive that income you need to estimate your outgoings. Once your estimated sales are in place, you need to add in when you expect payments to be received.Īs you probably know, you’ll need to factor a delay for most payments (most payments are usually 2 weeks late). Things to consider include any promotional activity or product launches, and the activity of competitors too. Take a look at the current state of the market and any emerging trends, as these may have an impact on your business. When estimating these sales, it’s important to take any future plans into consideration too. If you’re just starting your business, then you can use data from suppliers, industry experts and even competitors to make predictions. Take note of any seasonal patterns, or the impact of promotions you have run in those months. The easiest way to do this is to look at your sales history from the last few years. To start, you need to estimate your likely sales for the weeks or months covered by your cash flow forecast. There are three key elements to include in a cash flow forecast: your estimated likely sales, projected payment timings, and your projected costs. What should be included in a cash flow forecast? This means that its liabilities exceed its assets, unless its ongoing revenue covers its debt obligations. With some effective cash flow forecasting, however, things shouldn’t get to that stage. If a business runs out of cash (and can’t get a loan or funding) it will become insolvent. You can also run best and worst case scenarios to see how your business will cope in difficult times, or what you’d be able to afford to do if trading is better than projected. If you can predict any cash surpluses or shortages on the horizon, you’ll be able to make more informed business decisions. Running hypothetical business changes through your cash flow forecast is a great way to predict their impact. If you’re planning on hiring, for example, you can add the salary and related costs to see how it’ll affect your business’s financial position.

It also includes your projected income and expenses. A cash flow forecast is a document that helps estimate the amount of money that’ll move in and out of your business. Understanding your cash flow is vital for your business and forecasting plays an important role in your finances.

0 kommentar(er)

0 kommentar(er)